UK Property Market Trends: What Investors Need to Know in 2024

Oct 26, 2024

4 min read

3

7

0

As we move through 2024, the UK property market continues to evolve, offering both challenges and opportunities for investors. At Eclipse Partners, we keep a close eye on these trends to help our clients navigate the market with confidence. Whether you’re a seasoned investor or looking to make your first move, understanding the current property landscape is crucial to maximising returns. In this blog, we’ll explore some of the key trends shaping the UK property market right now.

1. Cooling House Prices, But Resilience in Key Regions

After the sharp price increases seen during the pandemic, UK house price growth has slowed in 2024. Higher interest rates and the cost of living crisis have dampened demand in some areas, causing a slight cooling in national average prices. However, this trend is not uniform across the country.

Certain regions, particularly in the North and Midlands, continue to show resilience. Cities like Manchester, Birmingham, and Leeds are experiencing steady demand, driven by strong rental markets and regional investment. These areas present opportunities for investors who are looking for growth markets outside of the overheated South East.

At Eclipse Partners, we focus on sourcing properties in these high-growth regions, helping our clients tap into emerging markets that still offer solid potential for capital appreciation.

2. Interest Rates and Their Impact on Buy-to-Let

With the Bank of England maintaining higher interest rates to combat inflation, the cost of borrowing has risen. This has led to increased mortgage rates, which in turn affects affordability for both homebuyers and buy-to-let investors. However, while some investors are adopting a more cautious approach, the rental market remains buoyant.

Higher mortgage costs are pushing more people into renting, which is driving up rental demand. In fact, rents have continued to rise in many parts of the country, particularly in urban centers where supply is constrained. For investors who can secure the right deals, buy-to-let still presents a compelling opportunity, especially as rental yields increase.

At Eclipse Partners, we work with clients to structure financing options that take into account the current interest rate environment, ensuring that buy-to-let investments remain profitable even in a higher-rate market.

3. The Rise of Regional Cities

While London remains a global property hotspot, high prices and low yields are causing many investors to look elsewhere for better returns. Regional cities like Manchester, Liverpool, and Birmingham are becoming the focus for property investors due to their relatively affordable prices and strong rental demand.

Major infrastructure projects, such as HS2 and various urban regeneration schemes, are also boosting the appeal of these cities. These factors are driving both capital appreciation and rental growth, making them attractive for long-term investment.

At Eclipse Partners, we specialize in sourcing properties in these dynamic regional markets, helping investors capitalize on the shift away from London-centric investment.

4. Build-to-Rent Continues to Grow

The build-to-rent (BTR) sector has seen significant growth over the past few years, and this trend is set to continue in 2024. With more people renting than ever before, BTR developments are meeting the demand for high-quality, professionally managed rental accommodation, particularly in urban areas.

For investors, BTR offers a hands-off investment opportunity with predictable rental income and growing demand. These purpose-built rental properties often appeal to young professionals and families, offering modern amenities and long-term tenancy options.

Eclipse Partners works with developers and investors looking to enter the BTR market, helping them identify prime locations and properties that are positioned for success in this expanding sector.

5. Sustainability and Energy Efficiency

As energy costs remain high and environmental regulations become stricter, sustainability is becoming a key factor in the UK property market. Buyers and tenants alike are prioritising energy-efficient homes that offer lower running costs. In fact, properties with higher Energy Performance Certificate (EPC) ratings are often attracting higher rents and quicker sales.

For investors, this shift toward sustainability is both a challenge and an opportunity. Upgrading properties to meet modern energy standards can require upfront investment, but the returns in terms of higher rental yields and improved resale value can be significant. Additionally, more sustainable properties are likely to remain compliant with future regulations, making them a safer long-term investment.

At Eclipse Partners, we help our clients identify opportunities to add value through energy-efficient improvements and guide them on how to meet upcoming regulatory requirements.

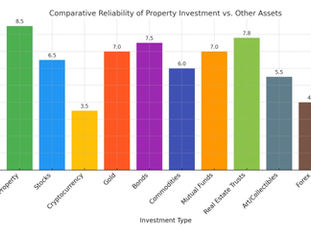

6. The Importance of Diversification

In today’s shifting property market, diversification is more important than ever. Savvy investors are spreading their investments across different property types—such as residential, commercial, and mixed-use properties—and across different regions. This strategy helps to mitigate risk and ensure steady returns, regardless of market fluctuations.

At Eclipse Partners, we advise clients on building a diversified property portfolio that balances potential risks and rewards. Whether you’re looking to invest in residential buy-to-let properties, explore commercial spaces, or tap into the growing build-to-rent sector, our team is here to ensure your investments are well-positioned for future growth.

What Do These Trends Mean for Investors?

The UK property market in 2024 is presenting a more nuanced landscape than we’ve seen in previous years. Rising interest rates and inflation have changed the dynamics, but opportunities are still abundant for those who can adapt. Key trends such as the rise of regional cities, increasing rental demand, and the growing importance of sustainability provide new avenues for investors to explore.

At Eclipse Partners, we are dedicated to staying ahead of market trends and helping our clients make informed decisions. Our property sourcing services focus on identifying high-growth areas, securing financing solutions, and providing strategic advice to ensure your property investments remain profitable and resilient.

Partner with Eclipse Partners to Navigate the Market

Whether you're an experienced property investor or just beginning your journey, Eclipse Partners is here to help you succeed in today’s evolving property market. With our deep expertise in regional markets, buy-to-let investments, and sustainable property solutions, we provide the insights and guidance needed to grow your portfolio with confidence.

Contact us today to learn how we can help you leverage these trends to achieve your investment goals.